Use Your Power to Find Energy Savings

A Guide to Energy – and Money – Saving Opportunities for Consumers

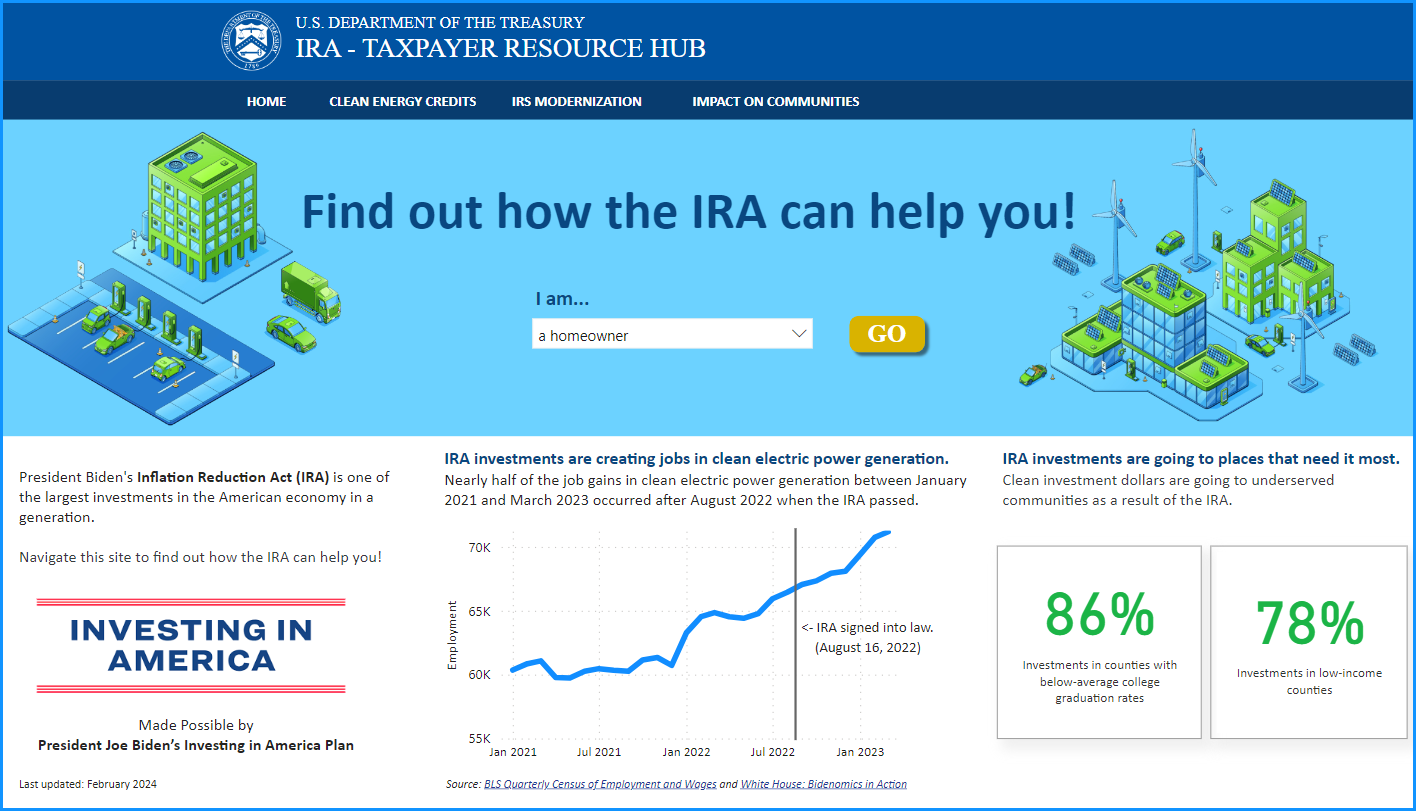

Are you interested in saving money and reducing your home’s energy consumption? Through the Inflation Reduction Act (IRA), you could be eligible for several new tax credits and rebates to make energy-saving and clean energy home improvements and upgrades!

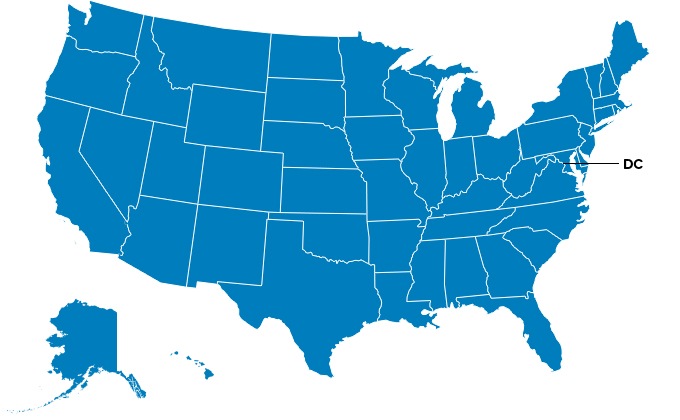

The IRA includes incentives to upgrade your home’s appliances, purchase an electric vehicle, install residential clean energy equipment, and more. You can take advantage of the tax credits now. The IRA’s Home Energy Rebate programs are coming soon — they will be offered by states, territories, and Tribes, and will begin coming online later in 2024. Check the status of your state’s rebate programs.

By taking advantage of these IRA programs, you can save energy – which can help lower your energy costs – and save money through rebates and tax credits.

Use your power – and this guide – to find energy savings today!

Tax Credits for Homeowners and Renters

Save up to 30% each year on energy-saving home upgrades.

- Through the Energy Efficiency Home Improvement Credit, you can get up to $3,200 in tax credits each year when you improve your home’s energy efficiency with heat pumps, insulation, efficient doors and windows, electrical panel upgrades, and energy audits.

For More Information

Save up to 30% on the costs of installing clean energy equipment.

- The Residential Clean Energy Credit helps you save money on installing clean energy to power your home, including private (rooftop) solar panels, wind turbines, geothermal energy, and battery storage.

- Take advantage sooner rather than later, because this incentive will be reduced to 22 percent by 2034.

For More Information

Find Rebates for Homeowners and Renters

The IRA’s Home Energy Rebate programs will begin coming online in 2024. Check the status of your state’s rebate programs. Once your location’s programs come online, possible incentives include:

Savings on upgrading your appliances and systems to energy-saving versions.

- Rebates may be available to you for numerous upgrades, including:

- Heat pump-enabled clothes dryers, water heaters, and space heating and cooling systems

- Electric stoves and ovens

- Electrical wiring and panels

- Insulation, air sealing, and ventilation

- If your household income is about average for your area (between 80% to 150% of the area median income), you may be able to save up to 50% on the cost.

- If your household income is below average for your area (less than 80% of the area median income), you may be able to save up to 100% on the cost.

- The maximum total rebate is $14,000.

- If your household income is high for your area (above 150% of the area median income), you may be eligible for a rebate of up to $2,000 on projects that reduce your energy use by 20%, and up to $4,000 if you reduce your energy use by 35% or more.

For More Information